The next wave of healthcare reform won’t be coming from the federal government. Nor will it emerge from the policy think tanks, the insurance industry, the hospital systems, or medical academia.

The next wave of healthcare reform won’t be coming from the federal government. Nor will it emerge from the policy think tanks, the insurance industry, the hospital systems, or medical academia.

In fact, the driving forces already reshaping healthcare aren’t coming from within healthcare at all. The transformative heat and pressure are from the world’s biggest tech and finance companies on one side, and from good old-fashioned grass-roots consumerism on the other.

Simply put, the corporate world is as fed up with the healthcare status quo as are ordinary families. And from both sides, that frustration is leading to the development of new care models that, in some cases, leapfrog over existing systems.

In IT circles, people speak gleefully of “Uber-izing” healthcare. That means stripping out inefficiencies, optimizing operations, increasing accessibility, driving down costs, and improving convenience.

In Silicon Valley, there are plenty of entrepreneurs—and investors—who believe the “legacy” systems—major insurers, managed care plans, big hospital systems—have had more than enough time to improve their offerings. Years of continuously rising costs, diminishing health outcomes, frustrated practitioners, and patient dissatisfaction are ample evidence that the people running these systems either cannot or will not undertake the innovations needed to truly improve American medicine.

In IT circles, people speak gleefully of “Uber-izing” healthcare. That means stripping out inefficiencies, optimizing operations, increasing accessibility, driving down costs, and improving convenience.

It is not a question of “if” or “when” these new models will take shape. It’s already happening. The questions are really, “How fast?” and “How well will they deliver on their promises?”

Amazon’s Haven….or Hell?

Amazon’s Haven….or Hell?

Consider Haven, the new joint venture between Amazon, Berkshire Hathaway, and JP Morgan Chase.

Late in 2017, these three corporate titans announced they were going to join forces to do “something” in healthcare.

More than a year later, that “something” is still a big question mark. All we really know is that it’s called Haven, and that its backers are committing serious resources toward the goal of improving healthcare –and health status–for their one million-plus employees.

Haven’s leaders acknowledge an uncomfortable truth about American life: people with adequate financial resources and reliable access to good medical care can expect to live well past 80, and healthfully; but the millions of people who lack funds and access will suffer a lot more illness and disability, and live shorter lives.

“The advances in modern medicine have been remarkable, but even with insurance, many Americans do not have the basics,” Haven’s leaders state on the company’ website.

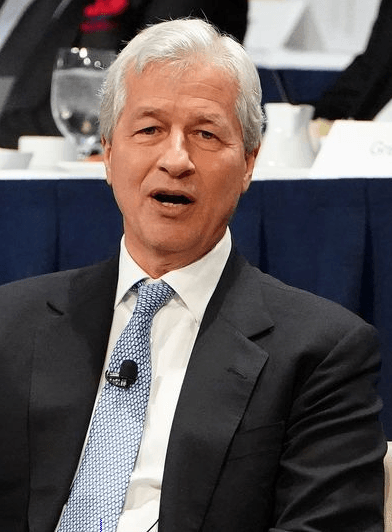

Leaving aside the reality that Amazon employs—and some would say exploits–many people who fit into that latter category, and that JP Morgan Chase CEO Jamie Dimon could not explain to Rep. Katie Porter (D-CA) how a Chase bank teller making $2400 per month could possibly meet her real-world monthly expenses, Haven seems intent on driving a substantial revision of healthcare’s business-as-usual.

Morgan Chase CEO Jamie Dimon could not explain to Rep. Katie Porter (D-CA) how a Chase bank teller making $2400 per month could possibly meet her real-world monthly expenses, Haven seems intent on driving a substantial revision of healthcare’s business-as-usual.

The company has not released any specific details on how it plans to make good on its stated goal to “deliver simplified, high-quality, and transparent healthcare at a reasonable cost.” But it is onboarding some heavy-hitting healthcare talent to run whatever this new model will be.

Haven’s leaders stress that this new venture is not for profit.

Berkshire Hathaway chairman, Warren Buffett, is on record stating, “The motivations are not primarily profit-making. We want our employees to get better medical service at a lower cost…..we do think that there may be ways to make real significant changes that could have an effect.”

At a meeting of the Economic Club of New York earlier this year, JPMorgan’s Dimon echoed Buffett’s statements.

“Ours is a not-for-profit thing. We want better outcomes for our people. We think we can save a lot of lives at our own company.” Though he withheld specifics, he did say that the new system is all about “data and analytics.”

Dimon said he backs the general concept of universal health insurance for all Americans, calling it a “national shame” for 40 million citizens to be uninsured. But he added that he’s no fan of ObamaCare, or for that matter, any of the reform ideas coming from Washington, DC. “The thing about ObamaCare is, it didn’t fix the fundamental problems. It just added more people to them.”

Dimon and Buffett say they have no intention to compete with existing systems, that the trio is not building its own insurance company, and has no immediate plan to compete with existing insurers.

But given the size of Amazon, Berkshire, and JPMorgan, and the technological, financial, and human resources at their disposal, such benign statements are kind of like the Jolly Green Giant insisting he won’t leave footprints as he dashes through the Valley of the Little Green Sprout.

“Ours is a not-for-profit thing. We want better outcomes for our people. We think we can save a lot of lives at our own company.”–Jamie Dimon, CEO, JPMorgan Chase

Between them, the three companies employ well over 1 million people. That’s bigger than a lot of regional insurance pools. Even if the triad does keep Haven “in house” for years to come, it will likely have big ripple effects.

Amazon alone has profoundly disrupted —for good and for ill–every business sector it has touched. There’s no reason to think Haven’s impact will remain within the corporate perimeters of its corporate backers.

Let’s be clear: Amazon’s core strengths are an exact match for mainstream healthcare’s biggest weaknesses: it gives people what they want, where and when they want it, quickly, conveniently, and for the lowest possible. The prices are clearly disclosed at point of purchase, and buyers can choose to search elsewhere for a better deal. On all those points, healthcare offers the opposite.

Haven is an independent entity that, “draws on resources and expertise from Amazon, Berkshire Hathaway, and JPMorgan Chase.” But the company has brought in some impressive outside talent.

Late last year, the triad announced that Atul Gawande, MD, will serve as Haven’s CEO. Best known for his popular book, Being Mortal: Medicine and What Matters in the End, a thoughtful treatise on life and death in an era of high-tech “solutions,” Gawande is an endocrinological surgeon who advised both the Clinton and Obama administrations during their respective stabs at healthcare reform.

Late last year, the triad announced that Atul Gawande, MD, will serve as Haven’s CEO. Best known for his popular book, Being Mortal: Medicine and What Matters in the End, a thoughtful treatise on life and death in an era of high-tech “solutions,” Gawande is an endocrinological surgeon who advised both the Clinton and Obama administrations during their respective stabs at healthcare reform.

He was one of the first physicians to call attention to the disturbing fact that there’s little correlation between money spent on medical services and health outcomes achieved.

Joining Gawande, as Chief Technology Officer, is Serkan Kutan, the former IT chief at Zocdoc, who played a key role in vaulting that company to its present status as a leading online medical appointment platform.

Haven also recruited David Smith, a former executive at UnitedHealth Group’s Optum division, which handles data analytics, pharmacy benefits management, and a host of IT-driven services. That move provoked a retaliatory lawsuit. UnitedHealth claims that by joining Haven, Smith broke his non-compete agreement and knowingly transferred sensitive information from Optum.

Industry-watchers say UnitedHealth’s touchiness indicates the degree to which it—and other insurance giants–feel threatened by the Amazon-Berkshire-Morgan alliance.

Last summer, Amazon spent roughly $1 billion to acquire PillPack, an online prescription fulfillment service. PillPack is licensed to ship prescription drugs in 49 states. Prior to the deal, Rx meds were among the only product categories not available on Amazon. PillPack now enables Amazon to compete with major chains like CVS, Rite Aid, and Walgreens, which have already lost sales of household staples to Amazon.

The three companies behind Haven have all the components to create an entirely new healthcare ecosystem.

It’s a safe bet that whatever emerges from Haven will benefit the executives and shareholders in Amazon, Berkshire, and JPMorgan. Whether it will be good for patients and practitioners is another question. It remains to be seen whether Haven can truly improve health and lower costs where others have failed. But there’s no question that the company is investing heavily toward that goal, and likely to make big waves.

Prime Meridian: The Scent of Change

Last year, the founding executives of doTERRA, one of the world’s largest marketers of botanical essential oils, announced plans to build a network of brick-and-mortar clinics that operationalize integrative medicine and make it more accessible.

This year, that vision started to become a reality, as Prime Meridian Health Clinics.

This year, that vision started to become a reality, as Prime Meridian Health Clinics.

Prime Meridian’s goal is to establish insurance-free, integrative primary care centers all over the country. They’ll be headed by holistic MDs, Dos, and Nurse Practitioners who will oversee a wide spectrum of other natural healthcare professionals.

Prime Meridian is based on a membership model: patients pay a monthly fee—roughly equivalent to their cellphone bills—for unlimited comprehensive primary care, 24/7 telemedicine access to practitioners, urgent care, wellness coaching, nutrition counseling, genome testing, and a host of functional medicine services.

Already, more than 40,000 people have joined Prime Meridian’s extended network, says Brannick Riggs, MD, Prime Meridian’s medical director.

“Our goal is to deliver life-changing healthcare,” said Riggs, a conventionally-trained family physician, who practiced in mainstream settings for years before becoming personally interested in essential oils. That led him to doTERRA.

“I was using the oils at home, and got to know the doTERRA executive team. They’d always wanted to partner with traditional western medicine practitioners, and they asked me to sit on their board.” Riggs worked closely with David Hill, DC, a founder of doTERRA, to develop Prime Meridian’s practice model.

Of the company’s decision to go entirely insurance-free, Riggs says, “We can’t bring in stuff from the old conventional system. It will poison the well. We don’t have to worry about coding and documenting for insurance plans, Medicare, or Medicaid. The only people making the healthcare decisions are the patients and the doctors. You’ll no longer have a 3rd party administrator in the picture.”

After piloting the model for doTERRA employees at the company’s headquarters in Pleasant Grove, UT, they opened the first stand-alone Prime Meridian clinic in St. George, UT, deep in the heart of Red Rock country, and a second one in Nashville. A third, in Phoenix, is slated to open later this year. Prime Meridian plans to have 50 to 100 centers across the country over the next few years.

doTERRA now accounts for 23% of the global aromatherapy and essential oils industry. It also offers a line of dietary supplements. But Dr. Riggs stressed that the Prime Meridian clinics will not be selling essential oils—or any other products. They will certainly be aromatherapy-friendly, but the company wants to send a clear message that these centers are true primary care facilities, not doTERRA dispensaries.

“We can’t bring in stuff from the old conventional system. It will poison the well. We don’t have to worry about coding and documenting for insurance plans, Medicare, or Medicaid. The only people making the healthcare decisions are the patients and the doctors.–Brannick Riggs, MD, Prime Meridian Health Clinics

It might sound crazy to open a chain of brick and mortar primary care clinics when many independent clinics are struggling to stay alive, massive insurance plans are aggregating physicians’ practices into ever larger networks, and many people avoiding physicians altogether, opting instead for self-diagnosis and self-treatment.

But the idea starts to make sense when one considers Prime Meridian’s massive potential patient base.

doTERRA’s multilevel marketing network includes well over 1 million distributors, and 5 million regular customers. The vast majority are women, and by the simple fact of their deep engagement with essential oils, they’re indicating a degree of dissatisfaction with mainstream medicine and a willingness to explore other alternatives.

On top of that, the company has 16 corporate offices worldwide, and directly employs 2,600 people. In short, Prime Meridian has its own ready-made market, and its leaders know a lot about their potential patients’ sensibilities, unmet needs, and preferences.

If it can deliver on its promises, Prime Meridian will be implementing “patient-centered” care in a way that health insurance industry pundits could not even imagine.

CrossFit Puts Healthcare in the Box

doTERRA’s not the only consumer-facing company that wants to whip healthcare into shape.

Over the last 6 years, CrossFit—the wildly popular branded fitness franchise—has been quietly recruiting an army of ripped and ready  physicians.

physicians.

Last year, the company’s decidedly unorthodox CEO, Greg Glassman, announced the launch of CrossFit Health—a network of fitness savvy physicians versed in CrossFit principles and practices, and able to interface with the company’s 15,000-plus affiliated gyms (or “boxes” as they’re known to CrossFit enthusiasts).

To that end, the company developed a special training program called MDL1—a medicalized version of its free two-day level-one training course. Since January 2018, CrossFit has hosted more than 340 doctors at its California headquarters. The program is also going global, with trainings in France and Brazil.

Like doTERRA’s Prime Meridian clinics, CrossFit Health taps into a large and active network of people who want something different from what mainstream medicine offers. CrossFitters want physically-fit doctors who understand things like intensity interval training, Paleo diets, and fast-mimicking regimens.

CrossFit health also plays to frustrated physicians tired of working in clinics where people often don’t get better and corporate overseers question their every decision.

“Nobody went to medical school to babysit someone through a life of self-inflicted misery because of two deadly habits: sedentarism and excessive consumption of refined carbohydrates” –Greg Glassman, Founder, CrossFit

The CrossFit culture is very different from sports medicine within conventional healthcare: it is marked by a renegade entrepreneurial spirit, a do-it-yourself ethic, and a customer-centricity that really does not exist anywhere within medicine.

Glassman hopes that CrossFit-savvy doctors will incorporate the program’s principles into their practices, giving patients new and meaningful tools for improving their health, while serving as conduits for patients to become paying CrossFit members. He also wants to see more physicians open up CrossFit boxes of their own.

Glassman hopes that CrossFit-savvy doctors will incorporate the program’s principles into their practices, giving patients new and meaningful tools for improving their health, while serving as conduits for patients to become paying CrossFit members. He also wants to see more physicians open up CrossFit boxes of their own.

CrossFit Health is very deliberately blurring the line between fitness coaching and medical practice. It is one more example of the ways in which creative thinkers from far outside the healthcare mainstream—Glassman is a college dropout who once had medical aspirations, and whose current business generates roughly $100 million per year—are attempting to remake 17% of our nation’s GDP.

There are certainly more examples:

TiaClinic, a three-dimensional incarnation of the popular women’s health app, recently launched its first center in lower Manhattan. The center bridges conventional ob/gyn services with naturopathic medicine. It is staffed entirely by women, for women. Tia is the vision of two under-30 entrepreneurs, Carolyn Witte and Felicity Yost, who wanted clinics founded on equal parts science, sass, and sex-positivity.

In an interview with the Cornell Alumni Association, Witte said the idea arose from her own frustration with mainstream medicine. “I thought to myself, ‘Here I am, I’m 25, I have a Cornell degree, I’m working at Google, I have the best insurance in the world. If I can’t figure out healthcare, how does anybody figure out healthcare.’ There has to be a better way. We really need to build a new model from the ground up.”

The clinic does take insurance, though not Medicaid, for its gyn and primary care services, and is in-network with most of the major  plans in metro-NYC.

plans in metro-NYC.

Tia has raised $6 million from investors, and hopes to open 20 clinics in the coming years. Initial response in New York has been very positive. Perhaps too positive. In April, Witte and Yost had to cap enrollment, and issue a letter to members acknowledging that the clinic had “missed the mark” on some of its promised services, owing to greater-than-anticipated signup rates and construction issues.

Forward: With its Starship Enterprise aesthetic and its promise of “Preventive healthcare powered by technology,” Forward hopes to attract young, healthy people, and provide them with tools to keep themselves that way. The business is built on an insurance-free concierge model—patients pay $149 per month. Clinics are staffed by MD-headed care teams.

The company has opened six clinics so far: two in New York City, two in Los Angeles, one in San Francisco, and one in Newport Beach, CA. Core services include 60-minute physician consults, a complete “3D body scan” utilizing real-time red light spectroscopy, a battery of conventional and functional medicine blood tests, a genome analysis, ongoing monitoring of various biometrics through wearable sensors, and access to Forward’s on-site pharmacies.

Though the company says it offers “primary care membership focused on prevention,” the centers are very different from typical primary care clinics. They’re more like wellness labs than medical facilities.

Forward’s founder, Adrian Aoun, was formerly a Google executive who oversaw Sidewalk Labs, the company’s project bringing tech-enabled care to poor urban neighborhoods.

Like CrossFit’s founder, Aoun’s a firm believer in the gym membership model: “You go to the gym with the goal of changing your body. It’s about continual engagement,” he told Business Insider. “We’re here to work on things that will affect you in 10 or 20 years. It’s not about just visiting the doctor’s office to address an issue and then being done.”

Time will tell whether any of these new ventures will be able to succeed where long-established insurance plans, hospital systems, and managed care networks have failed. Their emergence reflects the deep frustration with healthcare that Americans across the political and economic spectrum. It’s a restless urgency that no one involved in healthcare should be ignoring.

END